1. Introduction to Mortgage Chatbots

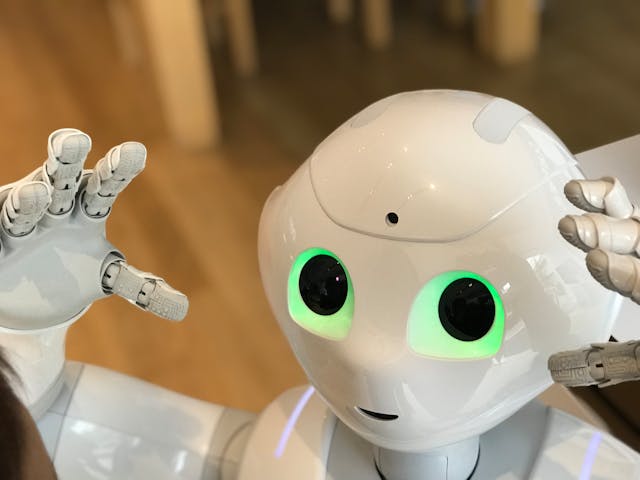

Virtual assistants called mortgage chatbots are created to improve and expedite the mortgage loan application process. These artificial intelligence (AI) solutions are designed to converse with consumers, responding to their questions, offering guidance, and supplying information as they proceed through the mortgage application process. Chatbots can provide individualized assistance, compute mortgage rates, clarify terms and conditions, and even aid with document submission by utilizing natural language processing capabilities.

Chatbots are essential to the mortgage sector because they automate repetitive activities and give consumers real-time support. Chatbots have revolutionized the mortgage industry by improving customer service efficiency and responsiveness by helping with pre-qualification exams and frequently asked inquiries. These digital assistants provide a smooth experience for consumers looking for information or direction on their home financing journey with their 24/7 availability and quick responses.

2. Importance of Efficiency in Mortgage Loan Process

In the mortgage loan procedure, efficiency is vital and affects both lenders and borrowers. Conventional mortgage procedures can entail a great deal of back-and-forth contact between several parties, arduous paperwork, and lengthy approval periods. For everyone concerned, these inefficiencies can result in mistakes, delays, and irritation.

Simplifying the mortgage application process is crucial for lenders to boost output, cut expenses, and maintain their position as industry leaders. Through the use of chatbots to automate tedious operations and streamline documentation procedures, lenders can dramatically reduce loan processing times without sacrificing accuracy or regulatory compliance.

On the other side, quicker approvals, easier access to cash, and a more seamless transaction are all advantages of a more streamlined mortgage procedure for borrowers. A more positive experience for homebuyers results from streamlining the process, which also enhances transparency and communication between borrowers and lenders.💾

Taking into account everything mentioned above, we can say that it is critical for lenders and borrowers alike to increase the efficiency of the mortgage loan procedure. Using chatbots and other similar technology not only expedites the loan processing time but also increases accuracy, lowers mistake rates, and improves the overall experience for all parties engaged in the mortgage lending process.

3. Benefits of Using Mortgage Chatbots

Numerous advantages provided by mortgage chatbots can greatly expedite the mortgage loan application procedure. The ability to automate the application process and accelerate it is one of these benefits. Borrowers can expedite the application process by using chatbots to swiftly and efficiently input their information without requiring human contact.

Mortgage chatbots are excellent at giving prospective borrowers prompt answers and assistance. These chatbots make sure that borrowers get help in real time whenever they need it, whether it be by calculating prospective monthly payments, providing answers to questions about various loan possibilities, or walking customers through the application process step by step. This rapid access to information not only improves customer satisfaction but also speeds up borrowers' decision-making.

4. Enhancing Customer Experience with Chatbots

Chatbots in the mortgage sector are transforming the client experience by allowing for unprecedented personalization of interactions with borrowers. These chatbots may customize discussions to each user's demands using sophisticated algorithms and natural language processing, resulting in a more tailored and human-like engagement. This level of customisation helps create trust and rapport, ultimately increasing the borrower's entire experience with the mortgage process.

The capacity of mortgage chatbots to provide continuous support and direction during the loan application process is one of its main advantages. Chatbots offer round-the-clock support, in contrast to conventional customer service channels that have restricted availability. This guarantees that borrowers may get the answers to their questions and guidance whenever they need it. This continuous availability guarantees that borrowers feel supported and appreciated at every stage of the process, in addition to expediting the loan application process.

Lenders may set themselves apart in a crowded industry by using mortgage chatbots to improve the client experience. Higher client satisfaction rates result from more seamless and effective loan processing, which is facilitated by personalized interactions and ongoing support. The goal of integrating chatbots into the mortgage loan process is to give borrowers a smooth, customized experience from beginning to end, not only to increase efficiency.

5. Real-life Examples of Successful Mortgage Chatbot Implementation

Numerous case studies illustrating effective mortgage chatbot implementations point to considerable gains in customer satisfaction and processing time. A well-known mortgage lender that included a chatbot in their loan processing system is the subject of one such case study. The time it took to complete loan applications was significantly reduced, from days to just a few hours, according to the results, making the process more streamlined and effective. Because of the chatbot's faster response times and user-friendly interface, customers expressed greater overall satisfaction.

The advantages of utilizing technology in the mortgage loan process are further highlighted by contrasting manual versus chatbot-assisted workflows. Customers frequently encounter delays and irregularities in traditional manual workflows because of human mistake or inadequate help outside of regular business hours. Conversely, chatbot-assisted processes allow for 24/7 support, immediate answers to questions, and tailored advice during the application process. This increased degree of efficiency not only expedites the loan approval process but also improves the client experience by offering prompt updates and assistance throughout the whole process.

6. Integrating AI Technology into Mortgage Industry

The mortgage sector is undergoing a change because to artificial intelligence (AI), which is improving client experiences and streamlining procedures. At the vanguard of this innovation are mortgage chatbots, which speed up the loan application process by giving customers immediate answers to their questions, assisting them with applications, and even making tailored recommendations.

The mortgage industry's adoption of AI technology has opened the door for more accuracy and efficiency in loan processing. Lenders can swiftly evaluate enormous volumes of data to determine borrower risk profiles and make better loan decisions by utilizing AI algorithms. This helps to reduce lending-related risks while also speeding up the approval process.

The potential applications of AI in mortgages seem endless. Natural language processing (NLP) advances allow chatbots to have more sophisticated conversations with clients, comprehending context and intent more accurately than before. Artificial intelligence (AI)-powered predictive analytics can predict market trends, enabling lenders to provide borrowers with customized packages and more competitive rates.

AI's uses in the mortgage sector will advance along with the technology. AI has the ability to completely transform the origination and servicing of mortgages, from fully automated underwriting processes to tailored loan recommendations based on individual financial profiles. In an industry that has always been complicated, like mortgages, embracing new technologies will increase accessibility and transparency while also increasing efficiency.

7. Overcoming Challenges in Implementing Mortgage Chatbots

Mortgage chatbot implementation can completely transform the mortgage loan application procedure, but it is not without its difficulties. Privacy and data security are two main issues. Deploying chatbots on safe platforms with robust encryption standards is crucial to addressing this. This guarantees the confidentiality and protection of sensitive data from cyber threats during the loan application procedure.

The effectiveness of mortgage chatbots also depends on their seamless integration with current procedures and systems. To find areas where chatbots can improve operations and uncover pain spots, a good approach is to perform a detailed analysis of current workflows. Chatbots that are tailored to these workflows are more efficient and cause less disruptions when they are put into use.

Ensuring a smooth integration of chatbots into the current infrastructure during the integration phase requires tight collaboration with IT teams and stakeholders. By gradually testing features and asking consumers for feedback, you may identify any problems early on and make the shift easier overall by resolving them quickly. By addressing concerns regarding data security and privacy while strategizing for seamless integration, mortgage chatbots can truly speed the mortgage lending process.

8. The Future of Mortgage Industry with Chatbot Adoption

The adoption of chatbots by the mortgage business appears to have a bright future as they continue to disrupt the sector. According to predictions, chatbot technology will advance to offer even more smooth and customized interactions, enabling speedier and more precise loan application procedures. It is anticipated that this development will have a major impact on application processing time, resulting in quicker approvals and payouts.

The incorporation of sophisticated artificial intelligence algorithms into chatbots may improve their capacity to precisely evaluate borrower profiles and offer customized financial guidance. This degree of customization could make the application process more accessible to a larger group of candidates, including individuals with credit histories or non-traditional financial backgrounds. Chatbots may contribute to financial inclusion and democratize mortgage loan access by providing more inclusive services.

In summary, we can expect a future in which mortgage applications are simple, quick, and easily accessible for people with a variety of financial situations as chatbot technology in the mortgage sector continues to develop. The development of chatbots has the potential to significantly alter the application and approval process for mortgages, which will eventually be advantageous to both lenders and borrowers.

9. Regulatory Compliance Considerations for Mortgage Chatbots

It's critical to take regulatory compliance into account while deploying mortgage chatbots. To protect sensitive personal information, this entails analyzing regulatory requirements such as data protection rules. Promoting openness and preventing discriminatory practices in the mortgage loan process requires strict adherence to industry standards for fair lending practices. Mortgage chatbots can expedite operations while respecting legal and ethical norms in the banking business by placing a high priority on regulatory compliance.

10. Training and Maintenance of Mortgage Chatbots

On the domain of mortgage chatbots, ongoing training is essential to improving chatbot functionality. Frequent training sessions help chatbots become more accurate and efficient in helping users with the mortgage loan process by enabling them to adjust to changing industry standards and consumer inquiries. As part of these training exercises, the chatbot is updated with the most recent details on mortgage products, policies, and procedures to guarantee that consumers receive accurate and timely responses.

For mortgage chatbots to be useful, they must be kept current with changing legislation. Chatbots can be kept compliant with evolving regulations and standards by putting methods into place such frequent audits, software updates, and industry monitoring. Organizations may guarantee that their automated systems give clients correct information while abiding by current regulatory norms in the mortgage business by integrating maintenance procedures into the chatbot's workflow.

11. Collaborations between Lenders and Tech Companies for Efficient Solutions

Collaborations between lenders and tech businesses have revolutionized the mortgage market, reducing operations and boosting consumer experience. These agreements result in the creation of innovative technology solutions that accelerate the mortgage lending procedure dramatically. The technological prowess of technology companies combined with the financial institutions' knowledge has led to the development of innovative technologies like mortgage chatbots, which automate duties like document gathering, application processing, and status updates for borrowers.

There are numerous advantages to these partnerships. First off, automation greatly increases efficiency by lowering human mistake rates and shortening the time it takes to approve a mortgage. These technologically advanced solutions improve accuracy and compliance by guaranteeing that the required documentation is quickly gathered and validated. Lenders can make more educated decisions about loan approvals based on comprehensive borrower information offered through digital channels by utilizing data analytics and machine learning algorithms.

Lenders and tech companies working together foster a mutually beneficial relationship whereby the former provides financial institutions with access to state-of-the-art technology that improves their offerings, while the latter gains practical uses for their innovations in the mortgage industry. In the end, this collaboration benefits all sides, but notably the borrowers who, as a result of these developments, enjoy a simpler and more effective mortgage loan application procedure.

12. Conclusion: Embracing Innovation in Mortgages with Chatbots

As I mentioned above, mortgage chatbots are essential for speeding up the mortgage loan application process since they help consumers instantly, streamline applications, and provide tailored advice. These chatbots improve client satisfaction, expedite processes, promote efficiency, and eventually make the mortgage market more competitive. In order to remain competitive in the modern digital arena, chatbot technology adoption is essential for embracing innovation. Mortgage lenders can differentiate themselves from the competition and achieve unprecedented levels of efficiency and client satisfaction by utilizing chatbots. It's time for the mortgage sector to take advantage of these technological developments in order to transform the way mortgages are handled and boost overall efficiency.